Every Business has a Value

Off Wall Street and outside of lecture halls the idea that every business has a certain value that a prospective owner would pay for the complete enterprise is intuitive. In fact, playing Monopoly with my eight year old and watching her haggle for Illinois Ave. illustrates just how intuitive price vs. value is, but somewhere between elementary school and when we first look at a stock's ticker we get lost. We start assuming that the stock price represents the business's value. This is usually not true.

Ignore Stock Prices

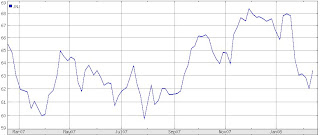

Let's look at a large stable company's stock price over the last year. I'm going to use Johnson & Johnson (JNJ) as my example, but any company would do. Here is a one year chart of the stock price:

Theoretically, an investor could have purchased JNJ for as little as $173 Billion or as high as $196 Billion over just 52 weeks. Do you really think that Johnson & Johnson's business value fluctuated by $23 Billion? That is what the stock price suggests. Let's look at another company's stock price Apple (AAPL) to see if its price gyrations are equally irrational.

52 weeks ago you could buy Apple for about $73 Billion then it shot up $100 Billion to $178 Billion and now you can buy it for less than $110 Billion. Talk about a roller coaster! Unlike amusement parks -watching charts, stock prices, and the market is hazardous to both your health and your wealth.

A business's value changes much more slowly than the quoted stock price. Over the short term the stock price is a proxy for investors expectations and emotions (two things that, for the most part, should be ignored).

Price Equals Value

Price is what you pay for, value is what you get"

-Warren Buffett

As investors we can profit by purchasing business when there is a large discrepancy between the price the market is offering a company for and the value of the underlying business. It is important to note that business's value isn't quoted on the stock market (or anywhere else) so it will take bit more work to find bargains. In future posts we will explore business valuation tools.

Efficient Markets

If you disagree, believe the market is efficient, or find that the idea that there is a disconnect between price and value inherently flawed, then I suggest investing in a low cost index fund. Please read my post on why indexing matters. There is nothing wrong with investing passively AND earning your fair share of the market's return. I'm very happy that many people subscribe to the Efficient Market Theory (I.e. Price = Value Theory) it creates opportunities for the enterprising investor.

Tea Leaves, Soothsayers, and Technical Analysis

Worse yet, if feel that the charts, and therefor the price, is signaling you and believe in soothsayers, tea leaves, and fortune tellers then you should search for "technical analysis" on your favorite search engine.

1 comments:

Just testing the comments feature.

Post a Comment